At least fifty percent of the money you’re going to make is going to come on the day you sell your business.

Joe Valley

That quote from my recent interview with Joe should serve as a hell of a wake-up call for every business owner reading this right now. It’s easy to get so in the weeds on the day-to-day business that you can lose sight of that fact.

With so much money on the line when it comes to selling your business, you need to get it right. And you can’t get it right without understanding your BUYER.

After building, buying, and selling 6+ of his own companies, Joe Valley helped build Quiet Light Brokerage, one of the leading online-focused M&A Advisory firms in the world. Now, after facilitating nearly half a billion dollars in exits, Joe has written the bestselling book The EXITpreneur’s Playbook – to help online business owners get the maximum value and best deal structure when they seek their own incredible exit.

Long story short, he knows his stuff, and you should definitely listen to our full conversation. But since you are here, I wanted to give you Joe’s list of the four of the biggest things buyers look for when buying a business.

(He technically gave five, one of which included “Who Owns the Business” and we spent a good portion of our conversation on being a good owner. Frankly, it would be a crime to cut it down, so I’ll let you tune in to the episode for the detailed breakdown on that.)

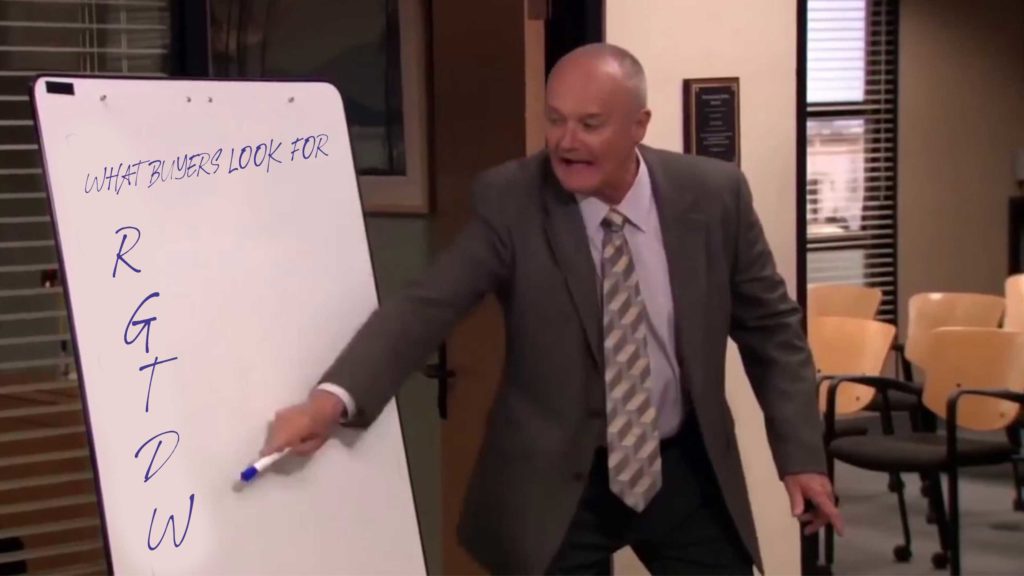

The five things that every buyer looks at when purchasing a business are RISK, GROWTH, TRANSFERABILITY, DOCUMENTATION, and WHO OWNS THE BUSINESS.

Sorry, “RGTDW” doesn’t make for a great acronym.

All right, jokes aside – let’s dive in.

Risk

“Risk can be determined by two primary factors.

- The age of the business.

- Twenty-four months seems to be the magic number, anything younger than twenty-four and the buyers seek a discount.

- Diversification or channel risk

- If you’re only selling on Amazon, you have far more risk than, say, Shopify and Amazon 50/50. That would mean less risk because you had two channels.

Simply put, the lower risk, the higher the value.

People who try to mitigate risk by buying a smaller business are actually doing the opposite. Their risk is higher because it is a less sizeable business, it doesn’t have a long life, it’s not defensible or sustained.

With a larger business, there are multiple channels of revenue, and you don’t want that single SKU or hero SKU that’s generating 70% of the revenue. That’s a big risk component.”

Growth

“If your business is growing steadily, buyers can predict the future.

If it’s up and down, up and down, up and down – it’s probably because you built it on a house of cards or you’re an entrepreneur that really just loves the business one year, and hates the business the next.

The buyer’s going to give a huge discount to lumpy growth or downward trends. They’re just looking at a return on their investment. So a three-time multiple of sellers’ discretionary earnings simply means that they’re going to get an ROI of breakeven in three years. If it’s trending down, it’s going to extend how long it’s going to take them to earn their money back, plus they’ll have to plug all the holes.

Growth trends are incredibly important and that’s Joe Valley’s favorite growth aspect of a business. Buyers just love built-in paths to growth, right?

Imagine going through the jungle and someone is out in front of you and they’re hacking down the path and making it easier for you behind them, that’s a built-in path. Do the same thing with your business and launch five new SKUs. You’ve got a total of 20, but you’ve launched five in the last 12 months. They’re all up and running, at least break even, and are growing toward an eventual profit. That’s a built-in path to growth. All a buyer has to do is let time pass.”

Transferability

“It goes without saying, if the assets of the business are not transferable to the new owner of the business, then you don’t have a sellable business. So if you have exclusive rights to sell the product XYZ on Amazon, but you can’t transfer those rights. You don’t have a sellable business.

Simple as that.”

Documentation

“Most people just screw up on their financials. 50% of entrepreneurs are probably using Excel. Unfortunately, they could be using QuickBooks or Xero. And those that are using QuickBooks or Xero are probably not doing accrual accounting.

They’re doing it in-house because they don’t want to pay a full-time bookkeeper, I don’t blame them. They should just outsource it now to an e-commerce bookkeeper and get it done right.

Documentation is so critical – it’s the starting point. Do you want to know how much your business is worth? Let’s run a P&L and then do an add-back schedule and see what your discretionary earnings are.

And let’s compare numbers and year-over-year, trends, etc. That’s the foundation of the value of your business. In most cases, some SAAS businesses can be valued as a multiple of revenue, but in most cases, it’s a multiple of discretionary earnings, discretionary earnings (adjusted EBIDTA).”

Who Owns the Business

Like I said at the beginning of the article, you definitely need to check out the full episode to hear Joe go in-depth in regards to what a quality business owner looks like and how circumstances can affect the length of time before an owner can step away after a sale. He even shares a fascinating story about working with a doomsday prepper – be sure to check it out!

Which of these four elements did you find most helpful? Let me know in the comments below! And be sure to grab a copy of Joe Valley’s book, EXITpreneur, today!

0 Comments